How is costs and charges disclosure dealt with in the new Review Report 2.0 and Continued Suitability Report?

Richard Lent

|

IMPORTANT – This user tip relates to an older version of Genovo. Although much of the content and many of the concepts still apply to the current version of Genovo, the screenshots and some instructions may no longer be accurate. |

Welcome back to the monthly user tip blog, which I am writing for the first time having only recently joined Genovo!

A subject close to all our hearts is MiFID II, so I thought I’d take a look at how the new Review Report 2.0 and Continued Suitability Report help you meet your obligations for disclosing ‘ex-ante’ (i.e. the forecast charges for the forthcoming 12 months) and / or ‘ex-post’ (i.e. the actual charges for the past 12 months) charges.

There have already been many discussions about how charges should be disclosed, but in this blog I hope to clarify:

- What options for costs and charge disclosure are included within Genovo;

- Where is costs and charges disclosure dealt with in the Genovo Report Builder; and

- How does the costs and charges disclosure appear in the resultant report.

NB. This blog isn’t intended to provide clarification of the rules or provide details of what resources providers will be making available, as this has received considerable coverage elsewhere. However, if this is of interest to you, I particularly like the work that the Lang Cat have done in putting together their ‘Advised Platforms and MiFID II Disclosure’ publication which can be downloaded here.

What options for costs and charge disclosure are included within Genovo

Prior to creating our Review Report 2.0 and Continued Suitability Report we carried out a large amount of research into the MiFID II requirements and looked at what charges data providers were going to make available. We also spoke to our users to understand what they wanted to show in their reports. From the research carried out, it is fair to say there is no one size fits all approach. For this reason we came up with the following options:

- Do not include the disclosure in the report

- Signpost to a separate charges statement

- Include a summary of platform’s charges statement (only available for ex-post disclosure.

- Include a breakdown of charges for investments only

- Include a breakdown of charges for investments and pensions

From the feedback received, the option to signpost to a separate charges document (probably one produced by the platform or product provider) is likely to be the most commonly used.

Where is costs and charges disclosure dealt with in the Genovo Report Builder

Having selected the Review Report 2.0 or Continued Suitability Report you’ll be directed to the Report Builder.

It is here that you would add the sections relevant to the type of review you are carrying out. In this example, I’m reviewing my client’s pension and investment, and recommending a new investment strategy.

The first step of the Important Information section is new, and it is here that you can choose how to display the costs & charges disclosure in your report.

Both ex-ante and ex-post disclosure have the following options, including the option to provide a breakdown at a plan level.

But ex-post also gives you the option to include a summary at platform level.

This option is intended for use where a summary of costs and charges for all assets held on one particular platform is to be provided, whereas the breakdown option would be used when providing the cost and charge detail at a plan level.

At Genovo, we like to give you as much choice as possible around how to display data. You can see that we have included the option of disclosing costs and charges for pensions, even though in the vast majority of cases they are not covered by the new MiFID II regulations.

How does the costs and charges disclosure appear in the report

Firstly, you can choose not to include the costs and charges disclosure’ and no reference to ex-ante or ex-post costs and charges will appear in your report.

Ex-ante

When choosing to signpost to a separate charges statement, the following text will appear in your report.

When choosing a breakdown of the charges for each plan, a table like this will be included in the report:

Reviewing multiple investments or pensions would create further rows in the table.

It’s worth noting that the Ex-ante charges table is pre-populated with the information you input into the ‘Plan Charges’ step of the ‘Review of Your Existing Pensions’ (or investments) section.

Therefore, if you’re recommending a new investment strategy for a plan, you should add the charges of the NEW investment strategy into the Investment Management Charge field of the Plan Charges step to ensure that a true representation of the forecasted charges of the plan is pulled through into the charges table that gets rendered in the report.

If you choose the option to include only a breakdown of the costs for the investment, then the table relating to the pension would not have been generated.

Ex-post

When choosing to signpost to a separate charges statement similar text will appear in your report.

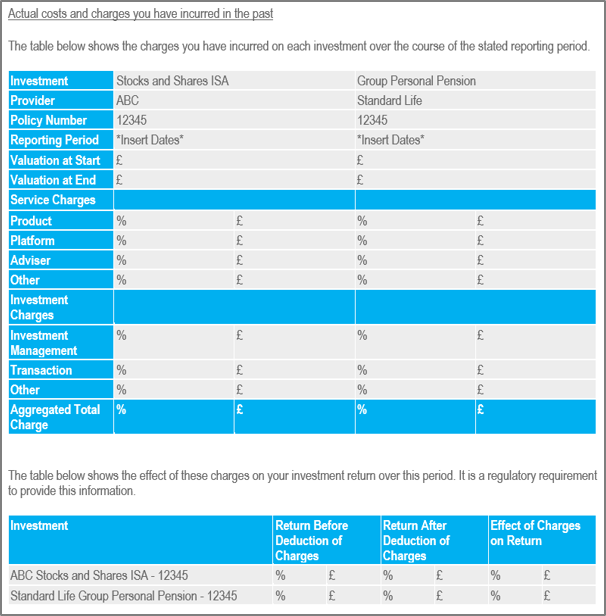

The following table will be included if you choose to provide a breakdown of charges at a plan level.

Due to the different ways and formats in which the information will be available from providers, it has been impossible to produce a table within the app that will prepopulate the information. This is therefore a semi-populated static template table, which you will need to transpose the relevant figures into from your data source once the report is downloaded.

The following table will be included if you choose to provide a summary of the charges taken at a Platform level.

Again this is a static template table and therefore will need to be completed once the report is downloaded to Word.

As with all the tables within Genovo, once downloaded they can be adapted to suit your requirements.

So I hope you’ve found my first user tip useful. Please do let us know what you think of the new reports; and as always, if you need any help or guidance just get in touch and we’d be happy to help.

Further Reading

You’ll find lots of useful information about the new report types and how they help you comply with your MiFID II obligations in our Knowledge Base or by clicking on the links below:

Changes to plan charges step in readiness for MiFID II

How do I write an annual review report for an existing client?

How do i write a Continued Suitability Report for an existing client?

Overview of the different report types