New APTA/TVC-related functionality added to Genovo

Ed Evans

Here’s a summary of the changes we’ve made to the Genovo suitability report app in response to the FCA’s Policy Statement 18/6 – ‘Advising on Pension Transfers’ in readiness for the new rules that become effective from 1 October.

Appropriate Pension Transfer Analysis (APTA)

As you are no doubt aware, with effect from 1st October 2018, the current transfer value analysis (TVA) will be replaced by a requirement to undertake an ‘appropriate pension transfer analysis’ (APTA).

It is widely believed that cash flow planning offers the most effective way to fulfil the requirements of the APTA. Whilst talking about what the FCA expects from cash flow planning, former FCA technical specialist, Rory Percival, was recently quoted as saying,

Think about how you present the cash-flow planning tool outputs to clients. The FCA have expressed concerns about seeing large cash-flow reports with multiple charts and asking ‘what is this really telling the client; is this clear?’

The outputs from cash-flow planning tools can often be quite extensive, detailed and also quite similar (i.e. a number of very similar looking charts). Do make sure that each chart is clearly explained so that the client can see how it differs from the last one. Explaining changes or spikes in the chart can also help.

In the suitability report, either summarise the charts and what they mean and cross-reference the cash-flow report or include the key charts in the body of the suitability report. If doing this, don’t overload the client, perhaps just include the base plan, the chart showing the recommended solution and a key stress test chart.

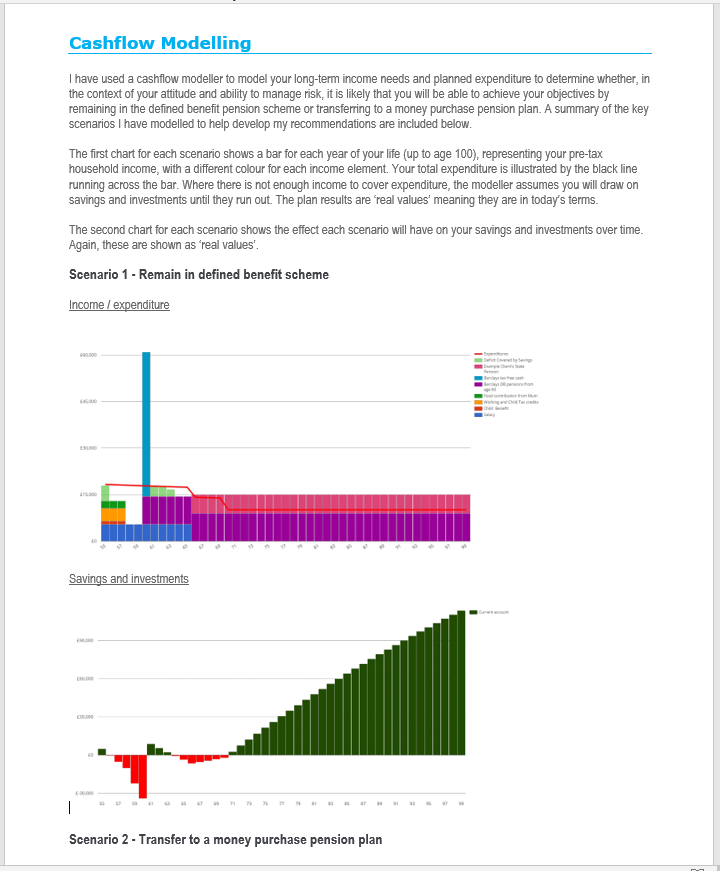

So with this in mind, we’ve added a new section – ‘Cash Flow Modelling: DB pension transfer’ – to the Advice Sections drop down within the Report Builder to allow you to summarise some of the key outputs of your cash flow modelling within your reports. The section has been added as a static template and comes pre-loaded with suggested wording to cover the following 4 scenarios.

- 1. Remain in the DB scheme

- 2. Transfer to a money purchase pension plan

- 3. Stress test scenario 1

- 4. Stress test scenario 2

Being a static template, you do not need to complete the section within the Report Builder. However, it is anticipated that having downloaded the report to Word, you would then drop in the relevant income and expenditure cash flow and savings charts using the windows snipping tool (or something similar), and add any extra commentary. So in terms of the finished report, you could end up with something like this.

In terms of the positioning of this section within a DB pension transfer suitability report, we’d suggest it’s added to the Report Builder after the Introduction section and before the review and recommendation sections as it will help set the scene and demonstrate the suitability of the personal recommendations being made in the later sections.

You can completely customise the content of this section to reflect your own advice process and personal preference in the usual way via the Report Content Manager.

It’s also worth remembering that you can easily reference, or signpost the reader to, the full cash flow planning report via the Supporting Information step in the Important Information section.

Finally, with cash flow planning becoming evermore common place, we’ve received a number of requests from our users to add a section to the Genovo suitability report builder where they can summarise the outputs of their cash flow modelling. So, we’ve also added 2 further static template sections to the Advice Sections drop down:

- Cash Flow Modelling: Retirement Planning

- Cash Flow Modelling: General Planning

Transfer Value Comparator (TVC)

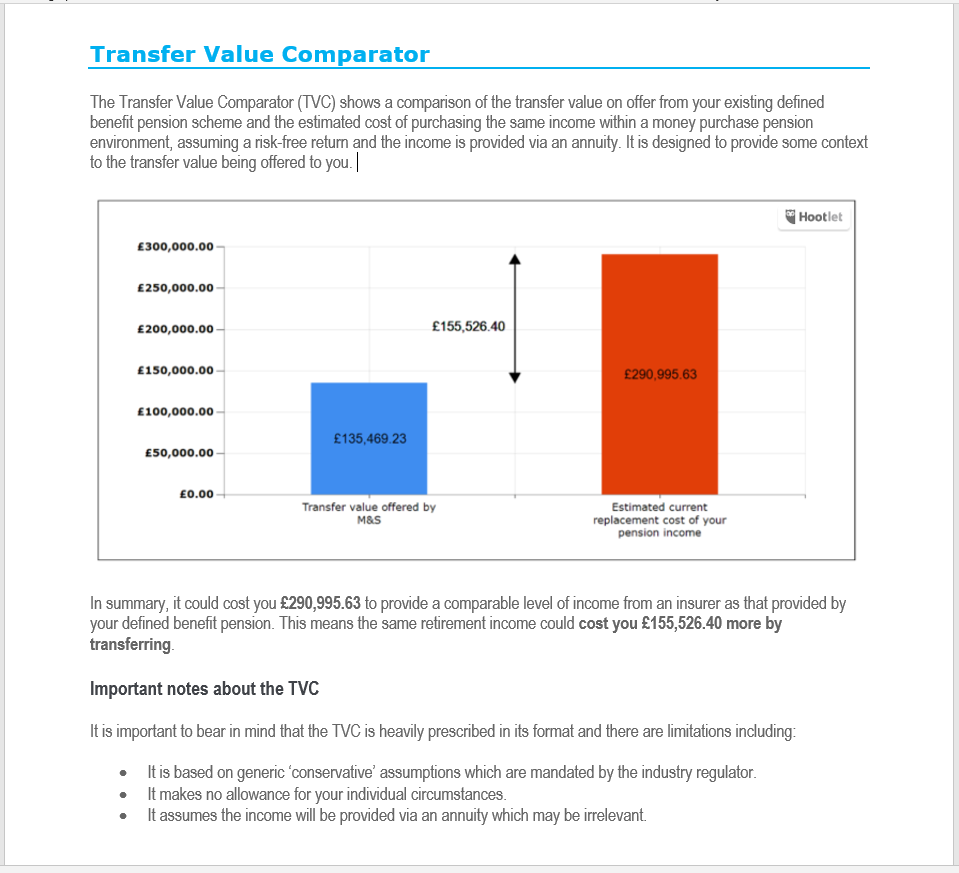

The TVC is a mandatory part of the APTA. As a result, we’ve created a brand new ‘Transfer Value Comparator’ section. This will be automatically inserted into the Report Builder whenever a recommendation is being made in relation to a DB pension, and on completion it could look like this in the report.

This section has also been added as a static template with pre-loaded wording, so you only need to drop in the bar chart on downloading the report to Word.

The section will be automatically inserted at the beginning of the appendix, but it is easy enough to move it around within the Report Builder using the reorder icons.

Once again it is possible to completely customise the content of this section to reflect your advice process and personal preference in the normal way via the Report Content Manager.

Transfer Value Analysis (TVA)

As previously highlighted, there will be less focus on critical yields and transfer value analysis following the introduction of APTA, and it will be left up to you to decide how valid this remains as part of a wider assessment.

The existing ‘Defined Benefit Pension Transfer Value Analysis’ section within Genovo will continue to be automatically inserted into the Report Builder whenever a recommendation is being made in relation to a DB pension. However, it is easy enough to remove it from a particular report, or hide it permanently from all of your reports should you not require it.

Given this change of focus, we have also reviewed the content of this section, made various changes to the wording and removed the subsection entitled ‘Fund required to purchase a comparable annuity’ as this has now been superceded by the TVC.

Client objectives

PS 18/6 also introduced the requirement (effective 1st April 2018) that all advice on the transfer of a DB pension should include a personal recommendation and clearly the introduction of the APTA has been designed to help demonstrate the suitability of the personal recommendation in the context of the customer’s objectives, as well as their attitude and ability to manage risk. However, it also highlights the importance of using personalised client-focused objectives in your suitability reports. To be honest, there’s nothing new here. This is something that we’ve been banging on about for a little while now – we even wrote a blog on it entitled Client Objectives in Suitability Reports: What the FCA Expects of You back in February 2015.

The real take-away from this is that for DB pension transfers (or any other area of financial planning for that matter) you really need to be including personalised client-focused objectives in your suitability reports, and NOT solution-led objectives like this one

You wish to take benefits from your pension fund using flexi-access drawdown as this will allow you to take the Pension Commencement Lump Sum to buy a rental property without having to draw an immediate income.

Attitude to transfer risk

CP 18/7 also proposes that in addition to assessing a client’s attitude to risk and capacity for loss, an adviser will also need to assess and consider the client’s attitude towards:

- The risks and benefits of remaining in the defined benefit pension scheme.

- The risks and benefits of transferring to money purchase pension plan.

- The restrictions the defined benefit pension scheme places on the individual to access their pension fund.

- Certainty of income throughout retirement.

- The likelihood of the individual needing to access their pension funds in an unplanned way.

It has been suggested that the suitability report should include a summary of this assessment, and hence we’ve added a new section entitled ‘Your Attitude to Transfer Risk – Security Versus Flexibility’ where you can do just that. This will be automatically inserted into your report as a new section (after the Introduction section) whenever a recommendation is being made to retain or transfer a defined benefit pension.

Once again it is possible to completely customise the content of this section to reflect your advice process and personal preference in the normal way via the Report Content Manager.

Advice options and advice reasons

We’ve reviewed and updated the standard advice options and advice reasons in the following steps.

| Section(s) | Step(s) | Update / Enhancement |

|---|---|---|

| Pension Review | Recommended Action | The advice reasons of all DB pension related recommended actions have been reviewed and updated. |

| Pension Review | Key Disadvantages & Tax Implications | All of the DB pension related advice reasons have been reviewed and updated. |

| Drawing Benefits From Your Pension Fund | Why Solution | The advice reasons of all the solutions have been reviewed and updated. |

| Drawing Benefits From Your Pension Fund | Other Solutions | A new advice option has been added to cover off the option of 'Staying in the scheme and taking out a life insurance policy to provide a tax-free lump sum payment on death' |

| Investment Strategy | Capacity for Loss | New advice options have been added relating to the use of cashflow planning to assess the client's CFL. |

Changes to the report template

We’ve made changes to the following snippets.

| Section(s) | Snippet Name | Update / Enhancement |

|---|---|---|

| Introduction | Attitude to Transfer Risk (DB only) | This is a new snippet which will be automatically included as a new section after the Introduction where you can summarise the client's attitude to DB pension transfer risk. |

| Pension Review | DB Pension Benefits (DB Only) Pension Scheme Elements (DB Only) Scheme Funding Level (DB Only) | The wording of these snippets has been reviewed and updated. |

| Cashflow Modelling: DB Pension Transfer *STATIC TEMPLATE* | Title & Opening Scenario 1 - Remain in scheme Scenario 2 - Transfer Stress testing scenario 1 Stress testing scenario 2 Assumptions | These are new snippets associated with this new section. |

| Cashflow Modelling: Retirement Planning *STATIC TEMPLATE* | Title & Opening Scenario 1 Scenario 2 Stress testing scenario 1 Stress testing scenario 2 Assumptions | These are new snippets associated with this new section. |

| Cashflow Modelling: General Planning *STATIC TEMPLATE* | Title & Opening Scenario 1 Scenario 2 Stress testing scenario 1 Stress testing scenario 2 Assumptions | These are new snippets associated with this new section. |

| Important Information | Remuneration | We've changed the title from 'Remuneration' to 'Cost of our services' |

| Risk Warnings | Defined benefit pension transfer | The wording of this snippet has been reviewed and updated. |

| Appendix - DB Pension Transfer Value Comparator | Title & Opening TVC Bar Chart Important Notes | These are new snippets associated with this new section. |

| Appendix - DB Pension Transfer Value Analysis | Title & Opening Comparison of Estimated Pension Benefits Critical Yield Hurdle Rate Drawdown Income Comparison of Death Benefits Important Notes | The wording of these snippets has been reviewed and updated. |

| Appendix - Technical Information | Defined Benefit Pension | The wording of this snippet has been reviewed and updated. |

Further reading

A lot has been written about PS 18/6 and the accompanying Consultation Paper CP 18/7 since their publication, but one of the best commentaries I’ve read on this subject matter has been the PFS Good Practice Guide – ‘A Practical Guide to Pension Transfers from Defined Benefit to defined contribution’. So if you can’t face wading through the 30+ pages of the original policy statement then I’d strongly suggest you give this a read.

Rory Percival has also recently published his own guide entitled Ex-Regulator’s Guide to Defined Benefit Transfers Suitability and Controls. It is broken down into three sections and covers the FCA’s rules and guidance, suitability, and risk controls.

Well that’s all for now folks – hope that’s been useful. Please do have a look and let us know what you think.