How Genovo handles Additional Permitted Subscriptions

Nigel Ogram

|

IMPORTANT – This user tip relates to an older version of Genovo. Although much of the content and many of the concepts still apply to the current version of Genovo, the screenshots and some instructions may no longer be accurate. |

Whilst we always love to chat with Genovo users, our preferred way to receive support requests is by submitting a support ticket. This way, we can immediately allocate the ticket to the most appropriate Genovo team member to help get the answer to you as quickly as possible. In the last few months, we’ve received a few support tickets asking how to write a report for a client using their Additional Permitted Subscription (APS), so we thought it would make a useful User Tip Blog.

In a nutshell, an APS is where a surviving spouse or civil partner is granted an additional ISA allowance (on top of their standard ISA allowance) equivalent to the deceased’s ISA balance.

Answering individual support tickets on this subject tends to be fairly straight forward, as a couple of simple questions allows us to give a very definitive reply. Ultimately, there are a couple of fundamental factors that dictate the solution, namely:

- Is the APS being made via a top-up to an existing ISA or a new ISA?

- Are you using the Suitability Report or Review Report 2.0 (don’t forget that since July 2022 it is now possible to recommend a new plan in a Review Report 2.0).

So, rather than try to explain all the possible permutations, I thought it would be easier to run through the main report wizard sections that an APS recommendation might require. It is also worth noting that this blog assumes you already know the basics of generating a report in Genovo – it won’t go into details of every step, but will just cover the specifics of writing a report to cover an APS investment.

Introduction

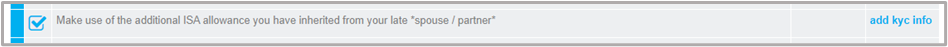

Clearly, you’ll always need the Introduction section, but the critical point here is that you select the appropriate objective.

This objective is one of the triggers that ensures the correct content is included in the Appendix to cover the investment of an APS.

If you want to use your own wording for the objective, you should still use the Genovo objective and then edit the text when you add the accompanying KYC info – this ensures that the Appendix content is still triggered.

Also in the Introduction section, you might wish to record the client as vulnerable (on the basis they’ve probably been recently bereaved). You can do this by clicking on the edit client details link in the Client Circumstances step (or the Client Circumstances Update step if you’re using a Review Report 2.0). This will generate extra content in the report highlighting that you provided the client with an option to have a friend or family member in attendance at the meeting, whether they chose to do so, and if they did, the name(s) of those in attendance.

Review of Your Existing Investments

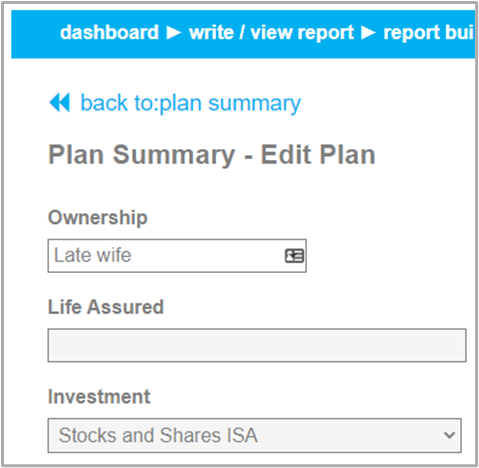

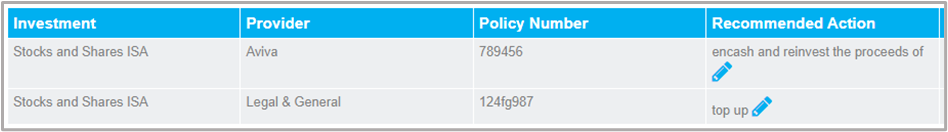

It’s within this section that you’re going to include details of the deceased’s ISA, as well as any existing ISA investments that the surviving spouse or civil partner already has.

A neat piece of Genovo functionality is that plans belonging to other individuals can be entered into a review section. This can be easily achieved by manually typing in something descriptive into the Ownership field when entering a plan.

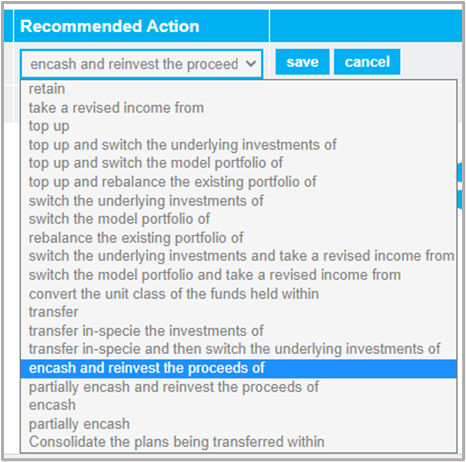

The Recommended Action you’ll need for the deceased’s ISA is ‘encash and reinvest the proceeds of’ (don’t use ‘transfer’ as it will trigger the replacement business steps, which aren’t needed for this scenario).

If you’re recommending that the APS be invested in the surviving spouse or civil partner’s existing ISA, you should also enter this plan into the review section, and select a Recommended Action of ‘Top up’ for it (or one of the other ‘top-up’ Recommended Actions, if you’re also recommending a change to the investment strategy).

New Investment Recommendation

However, if your recommendation is to set up a brand-new plan for the APS investment, this should be dealt with in the New Investment Recommendation section.

The first thing to bear in mind is that an APS is an increased ISA allowance and not a ‘product’. However, because Genovo is built around recommendation of products, APS is referred to as an Additional Permitted Subscription for ISA in the New Investment Recommendation section in Genovo. This is another of the triggers that ensures the correct content relating to APS is included in the report’s Appendix.

Recommended Investment Strategy

If you’re using a Suitability Report, you’ll always need this section, if only to record the clients risk profile (ATR). Whereas, if you’re using a Review Report 2.0, you will already have reviewed the client’s ATR in the Introduction section. If you’ve recommended a new plan for the APS investment, or you’re recommending a top-up to an existing plan, but with a change to the investment strategy, you’ll also need to detail the new investment strategy here.

In fact, the only scenario where you won’t need to include the Recommended Investment Strategy section is if you are using the Review Report 2.0 and you are recommending the APS investment is used to top up an existing plan with the new investment using the same investment strategy as the existing plan.

Nigel’s Golden Rules

As you can see, once you’ve worked out the basic choices (new plan or existing plan, Suitability Report or Review Report 2.0) it is relatively straight forward to complete an APS report in Genovo.

A final tip – if you find that you’re dealing with APS investments quite regularly, you might want to consider creating a template. If so, you may like our user tip blog about converting existing reports into templates.

Anyway, that’s it for another month. I hope this blog has shed a little light on how to write an APS investment report in Genovo.

Further Reading

You’ll find loads more useful information in:

- Genovo’s series of User Tip blogs;

- the extensive Genovo Knowledge Base;

- the collection of really useful Genovo matrices;

- the ever-popular Genovo video tutorials; or

- by attending one or more of our regular monthly training webinars.

Of course, if you’re still stuck or just need a helping hand, you can always submit a support ticket and we’ll get straight back to you.

Finally – make sure you don’t miss any of our hints & tips – subscribe and get email alerts when we update our blog.