How do I write a fund switch report in Genovo?

Nigel Ogram

|

IMPORTANT – This user tip relates to an older version of Genovo. Although much of the content and many of the concepts still apply to the current version of Genovo, the screenshots and some instructions may no longer be accurate. |

About 30 years ago, an advertising agency devised a simple but effective campaign for a company making a good-quality, but fairly unexciting product. I guess it’s pretty difficult to come up with anything exciting to promote a range of wood stains and paints, but HHCL and Partners came up with “it does exactly what it says on the tin” for Ronseal’s quick-drying woodstain.

Since then, the now-famous (and trademarked) catchphrase has entered common language to describe when something is straight to the point. According to Ronseal, it is now the third most-used slogan of all time. It’s even in the Oxford Dictionary of English Idioms – high praise indeed! If the woodstain industry was subject to its own form of Consumer Duty, Ronseal would pass with flying colours!

Anyway, my usual tortuous introduction is a way of saying that ‘Ronseal language’ is something that we try to adopt here at Genovo. We like saying things in a straightforward way as we believe it helps users to understand the Genovo app and get the most benefit from it. We also extend this to the language we use in reports, as we think that clients will want to read your recommendations in clear, concise terms. Remember the third outcome of Consumer Duty? Go to section 8 in the FCA’s PS22/9 document if you need a reminder. I suspect ‘Ronseal language’ is something the regulator would like us all to remember when communicating with clients.

One of Genovo’s most obvious use of ‘Ronseal language’ is for the five report types that you can choose from when starting a new report for a client:

- Suitability Report

- Review Report

- Fund Switch Report

- Top up / Bed & ISA Report

- Continued Suitability Report

This blog looks into the third of these report types and reveals the reasons why you should use this particular report type.

Why not use one of the other report types – it still works, doesn’t it?

Yes – it’s perfectly possible to document a recommendation to switch funds using a Suitability Report, Review Report 2.0 or Top-up / Bed & ISA Report, so why does Genovo provide a report type specifically to deal with fund switches?

Well – it’s simply for ease of use for you and ease of reading by the client. If all you’re recommending is a fund switch or change of investment strategy, then the Fund Switch Report will streamline the report writing process and result in a more concise and reader-friendly report covering all the pertinent points.

Writing the report

Below I’ve included a step-by-step guide on how you can quickly and easily write a brief, concise report to a client confirming your recommendations to switch the underlying investments of an existing investment, pension or drawdown plan.

1. Start your report in the normal way – go to write/ view report and then select (or add) the client. Don’t forget you can write the report on behalf of another user within your account if you have view all users’ clients and reports enabled.

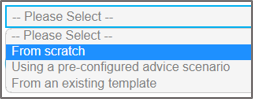

2. Next, the report creation method should be ‘From scratch’. However, there is also a Genovo Fund Switch Report Template that you could choose (which covers the switch of underlying funds in a pension), or of course you can easily create your own fund switch template by cloning an existing template, or building a report and then converting it to a template. This blog assumes you’ll be building the report from scratch.

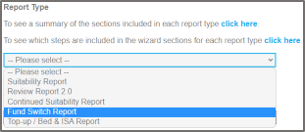

3. In Report Details, you will be prompted to give the report a name and choose the report type – select Fund Switch Report and then click Save.

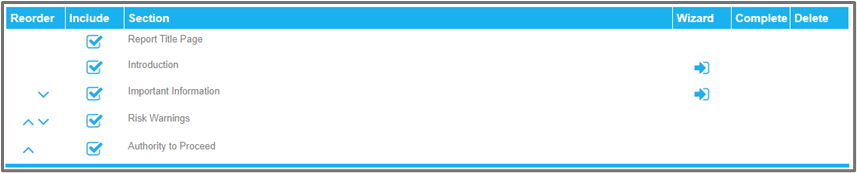

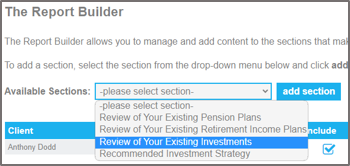

4. Once you’ve selected the report type, you’ll be taken to the Report Builder, where you will notice that there are only five sections – much less than you will find in a Suitability Report or Review Report 2.0. This is the first example of the streamlining that we’ve applied to the Fund Switch report type to make the process easier.

5. You’ll now need to add the required sections from the Available Sections drop-down list.

You’ll clearly need to add at least one review section, and as you’re recommending a fund switch, you’ll also need to add the Recommended Investment Strategy section – it’s in here that you’ll include details of the revised investment strategy.

6. Now, you should work through each of the wizard sections in turn, starting with the Introduction section, where you’ll be prompted to provide an update on the client’s circumstances and a review of their attitude to risk and capacity for loss.

7. Next, you should complete the review section(s).

a) You’ll be prompted to provide some basic information regarding the existing plan within the Plan Summary step of the review section. As a bare minimum you should include some basic plan details e.g. provider name, policy number etc and complete the Current Fund Value £ field. Remember, you do not have to enter a value for all fields. Empty columns will not show in the Plan Summary table included within your report.

b) You should also include details of the plan’s Current Investment Strategy.

c) After the Plan Summary step, you’ll need to complete the Plan Charges step, as this will be the basis of the ‘before’ charges disclosure.

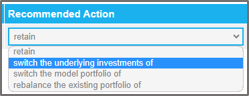

d) After Plan Charges is the Recommended Action step, where you’ll notice the second example of the streamlining that we’ve applied to the Fund Switch report type to make the process easier. There are only four Recommended Actions in the drop-down list (one of which is simply ‘retain’).

e) You’ll then be prompted to confirm the reasons for, and any disadvantages associated with your recommended action. The selection of either the ‘switch the underlying investments of’ or the ‘switch the model portfolio of’ recommended actions will also trigger the optional Plan Comparison: Investment Strategy Charges and Plan Comparison – Performance steps in the review section.

It’s in the plan comparison steps that you’ll be prompted to compare the impact of the charges and the past performance of the current and the new investment strategy you’re recommending (in line with FCA best practice). Note that selecting the ‘rebalance the existing portfolio of’ recommended action does not generate the plan comparison steps, as a rebalance generally does not result in a change to the charges or a fundamental change to the underlying investments.

8. Next, you’ll need to complete the Recommended Investment Strategy section detailing the revised investment strategy for each of the plans where you’re recommending a change to the underlying investment strategy.

Remember that there are three ways to create a new investment strategy:

1) Clone a Current Investment Strategy you’ve previously created in a review section of this report.

2) Create a new investment strategy from scratch.

3) Clone another Recommended Investment Strategy.

Each of these creation methods is covered in lots more detail in last month’s User Tip Blog – Everything you wanted to know about investment strategies in Genovo, and more…

9. Your final wizard section is Important Information and should be self-explanatory.

10. Having completed all the wizard sections, you should then tailor the structure of your report by unchecking any sections you do not wish to include in your report; and then change the sort order of any sections to reflect your personal preferences.

You’ll find more information about how to remove optional sections from your report here although because the Fund Switch report is already very streamlined, we doubt you’ll be able to remove very much (maybe the Authority to Proceed section if you don’t seek written instructions from the client).

You’ll find more information about how to reorder the sections here.

11. And finally, you can download your completed report, with a covering letter if required.

I hope that’s helped you to get to grips and have a better understanding of how to streamline your processes and write a more concise report, using the Fund Switch report type.

Nigel’s knowledge

The key takeaway from this blog is that you can make the task of writing reports much easier for yourself by using the range of Genovo report types.

The third outcome of Consumer Duty is Client Understanding, so by using Genovo’s streamlined report types (i.e. Fund Switch Report, Top-up / Bed & ISA Report and Continued Suitability Report), you’ll also be helping your client to understand your reports, by removing any unnecessary content and focussing on the recommendation.

Remember that although Genovo has a range of pre-constructed report templates, there’s only one template that uses the Fund Switch report type, but it’s really easy to create your own.

Further reading

You’ll find loads more really useful information in:

- Genovo’s series of User Tip blogs;

- the extensive Genovo Knowledge Base;

- the collection of really useful Genovo matrices;

- the ever popular Genovo video tutorials; or

- by attending one or more of our regular monthly training webinars.

Of course, if you’re still stuck, or just need a helping hand, you can always submit a support ticket and we’ll get straight back to you.

Finally – make sure you don’t miss any of our hints & tips – subscribe and get email alerts when we update our blog.