How do I write a suitability report consolidating one or more existing plans into another existing plan?

Nigel Ogram

|

IMPORTANT – This user tip relates to an older version of Genovo. Although much of the content and many of the concepts still apply to the current version of Genovo, the screenshots and some instructions may no longer be accurate. |

Last year, my colleague Simon wrote a series of three User Tip blogs on how Genovo helps you meet the FCA’s expectations when carrying out ‘replacement business’. You can read these three articles here.

- Part 1 – What, Why and How,

- Part 2 – Adding existing plan information

- Part 3 – Charges, performance and death benefit comparisons

These blogs go into the fine detail of a scenario of an existing plan being replaced by a newly recommended plan. However, before recommending a new plan to replace an existing plan, the FCA expects all advisers to consider using one of the client’s existing plans to receive the fund value from the plans being replaced.

While Genovo handles the ‘existing plan into a new plan’ scenario perfectly, the ‘existing plan into another existing plan’ scenario is a bit less obvious and requires a simple workaround. We get quite a few support calls and support tickets asking us how to do this, so we thought it would make a useful User Tip Blog.

Why is the workaround required?

A fundamental element of any ‘replacement business’ where investments, pensions or retirement income plans are concerned will be a comparison of charges. Currently, Genovo’s charges comparison calculations only compare an existing plan with a new plan, so the receiving plan still has to be added as though it was a new plan in order for the calculations to work properly and for the values in your report to be accurate. We appreciate this isn’t perfect, plans are in place to improve this in the near future, so please bear with us in the meantime!

The Report Builder

This blog doesn’t go into the fine detail of how to complete every step in every section – you can read the detail in the three-part blog mentioned earlier. Instead, I’m going to concentrate on the specific scenario of consolidating existing plans into another existing plan.

I’m also going to assume that you already know how to add a client and start a report. If you haven’t done this yet, I’d respectfully suggest that a ‘replacement business’ case is probably not the best advice scenario to break your Genovo duck with and you might be better off starting with a simpler case. The Building a Report section of the Genovo Knowledge Base would be a great place to start your Genovo journey. I also strongly recommend you have a look the eight video tutorials under the ‘How to write a report’ section in our Video Tutorials Knowledge Base article.

Report creation method

You’ll need to select the report creation method of ‘from scratch’ as unlike consolidating into a new plan, there is currently no Genovo report template or pre-configured advice scenario to use. However, once you’ve created your report, you can save it as a template to your report template library – have a look at the Genovo Knowledge Base articles on templates or even watch the short overview video.

Report type

You can use two of Genovo’s five report types – Suitability Report or Review Report 2.0. Clearly, if you’re reviewing the plans for an existing client, you’re likely to use Review Report 2.0 and if you’re dealing with a new client, it’s going to be the Suitability Report. The sections and steps you’ll need for this advice scenario are almost identical regardless of report type, but the screenshots in this blog will show a Suitability Report.

Product type

For the purpose of this blog, we’re going to be consolidating two existing stocks and shares ISAs into another existing stocks & shares ISA – a pretty common ‘replacement business’ scenario. However, the process is broadly the same whether its investments, pension or retirement income plans that you are consolidating.

Report sections

Having started the report, you’ll need to add the required sections. The process of building the report is the same as it would be for any pension switch, investment switch or ISA transfer, so you’ll need one or more of the relevant review sections:

- Review of Your Existing Investments

- Review of Your Existing Pension Plans

- Review of Your Existing Retirement Income Plans

Although you’re not recommending a new plan, adding the new recommendation section will ensure that the charges disclosure is dealt with correctly in your report to meet your regulatory requirements, so for each of the review sections above, there needs to be a corresponding recommendation section.

- New Investment Recommendation

- New Pension Recommendation

- Drawing Benefits from Your Pension Funds

Depending on which report type you’ve selected, you may also need a Recommended Investment Strategy section – see below.

The review section

Plan Summary step

The first step of the review section is the Plan Summary step. It’s here that you’ll need to add all the plans being reviewed, including the one being retained.

Benefits & Features step (Pensions and Retirement Income plans only)

An important compliance requirement on any ‘replacement business’ case is the disclosure of any features or benefits of the plan(s) being replaced that will be lost on switch / transfer. As pension products tend to have quite varied features, there’s a dedicated step for this. For investments, just use the Key Disadvantages & Tax Implications step.

Charges step

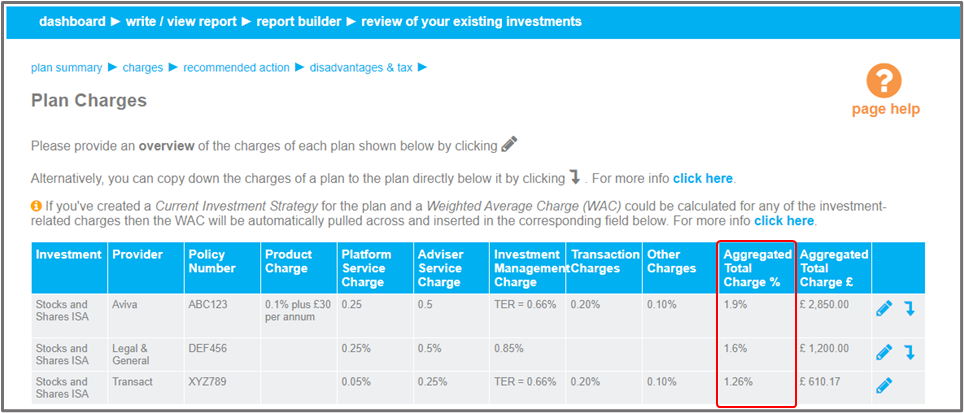

Complete the charges information for all existing plans as appropriate. Make sure you enter the Aggregated Total Charge % value, as this represents the ‘before’ charges.

You’ll also be comparing this figure with the Aggregated Total Charges of the ‘new’ plan in order to complete the Plan Comparison – Plan Charges step.

Recommended Action step

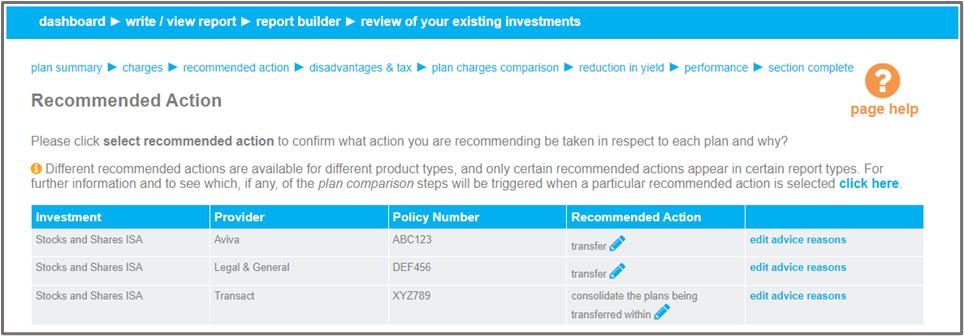

Next, you should select the appropriate Recommended Action for each plan (and also complete the associated advice reasons to support each Recommended Action).

For the plan(s) being replaced, the Recommended Action will be one of the following:

Investments

- For ISAs – ‘transfer’

- For all other investments, one of the following, as appropriate:

- encash and reinvest the proceeds of

- partially encash and reinvest the proceeds of

- transfer in specie the investments of

- transfer in specie and then switch the underlying investments of

Pensions and Retirement Income Plans

For all money purchase pension plans, the Recommended Action will be one of the following:

- switch

- partially switch

- transfer in specie the investments of

You should note that Genovo reserves ‘transfer’ for defined benefits schemes only, but that’s an entirely different can of worms for another day and another User Tip Blog!

For the existing plans that are to receive the funds from the plans being replaced, the Recommended Action will be:

Investments

- For ISAs – ‘consolidate the plans being transferred within’

- For all other investments, use ‘consolidate the plans being encashed within’:

Pensions

- For all money purchase pensions, you should use ‘consolidate the plans being switched within’

If you want to know more about the range of Recommended Actions available, there’s a really useful Recommended Action Matrix which lists all the Recommended Actions available for each review section.

When you’ve finished selecting the Recommended Actions, you should have something that looks a bit like this:

Plan Comparison steps

Note that this stage of the ‘replacement business’ scenario is covered in much more detail in Part 3 of our recent three-part blog on ‘replacement business’.

Any of the ‘replacement business’ Recommended Actions will trigger the Plan Comparison steps:

- Plan Charges – the difference between the Aggregated Total Charges from the charges step of the review section and the same value from the charges step of the new recommendation section.

- Reduction in Yield – designed to reinforce the Plan Charges comparison step.

- Performance – if performance has been cited as a factor for replacing the current plan, we would expect to see supporting information here.

- Death Benefits (Pensions and Retirement Income Plans only).

You should complete these steps as required to support the recommendation to consolidate plans. None of the individual plan comparison steps are mandatory, as the method of comparison may differ between cases (for example, you may not be citing performance as a reason for the replacement). However, in our view and in light of the compliance implications of ‘replacement business’, you should complete as much as possible to make the case watertight.

The new recommendation section

On the face of it, you’d think that selecting a Recommended Action of ‘consolidate the plans being transferred within’ for the ISAs being replaced would mean that only the Review of Your Existing Investments section would be required. However, there is currently no ability within the review section to record the plan charges after the recommendation (although a fix for this is coming soon!) The Plan Charges Comparison step of the Review of Your Existing Investments section provides the ability to state the increase or decrease in charges, but this is used to calculate the difference in the charges between an existing plan and a new plan (rather than a ‘before and after’ for the existing plan). This is why we need to include the existing plan as a ‘new’ plan in the New Investment Recommendation section.

Plan Summary step

When completing the New Investment Recommendation section, as you add details of the existing plan being used for consolidation into the Plan Summary step, the figure entered into the Transfer Lump Sum field should be the total amount being transferred in from all of the existing plans that are being consolidated. Do not include the current value of the plan in this amount. This way Genovo will be to calculate the ex-ante costs for the next 12 months based on the amount being transferred in, and provide a fair comparison with the combined costs and charges of the plan(s) being transferred in.

‘Why’ steps

Complete the Why Product, Why Contribution (if a pension case) and Why Provider / Plan steps in the usual way.

Plan Charges step

When you get to the Plan Charges step, add details of the charges of the receiving plan in their entirety. i.e. if the charging structure is tiered and the overall charge will reduce following the transfers in, insert the charges applicable to the entire value of the combined investment, not just the amount being transferred in. In our ISA transfer scenario, the charges step will look something like this:

Note that in this case, the Annual Recurring Charges are the same as the charges step of the existing plan in the Review of Your Existing Investments section. Of course, they are likely to be different if a new investment strategy is being recommended.

Once this is done, complete the remaining steps of the section with as much detail as required.

Recommended Investment Strategy section

Regardless of whether you’ve used a Suitability Report or a Review Report 2.0, if you’re recommending a new investment strategy for the existing plan that’s receiving the plans being replaced, you’ll obviously need to include the Recommended Investment Strategy section.

However, it’s entirely possible that the Current Investment Strategy of the existing plan is fine and there is no need for it to be changed. In this case, whether you need the Recommended Investment Strategy section depends on which report type you selected when creating the report.

If you selected Suitability Report, you’re still going to need the Recommended Investment Strategy section, as it also covers attitude to risk and capacity for loss. You should note that if the Recommended Investment Strategy section is included in a Suitability Report, but an investment strategy is not entered, Genovo knows that it has only been included to use the ATR and CFL steps and the section is renamed to ‘Your Risk Profile’ in the downloaded report. On this basis, you might want to consider moving the placement of the section on the Report Builder to just below the Introduction section.

If you used a Review Report 2.0, then it’s simpler, as attitude to risk and capacity for loss are dealt with in their own step of the Introduction section, so if you’re not recommending a new investment strategy for the plan receiving the replaced cases, you don’t need to include this section.

The downloaded Word report

Once you’ve completed all the wizard sections, you’re ready to download the report. When the report is downloaded to Word, you’ll notice that there are references to the ‘New’ plan throughout. I would suggest using the find functionality (Ctrl+F) in Word to find all instances where ‘New’ is mentioned and tweak the wording to reflect the fact that in this instance the ‘new plan’ is actually an existing plan.

As an example, in the scenario used for this blog, I would rename the New Investment Recommendation section to “Your Existing Transact ISA Recommendation” Don’t forget, if you’ve used a Suitability Report, you’ll need to rename it in the Executive Summary too. Finally, don’t forget to update the Table of Contents too.

I hope that’s helped you to get to grips and have a better understanding of how to write a report when consolidating plans within another existing plan. If you have any further questions, please do get in touch or submit a support ticket and we’ll get straight back to you.

Nigel’s knowledge

Although we’ve spent a lot of time and effort making sure Genovo can handle just about any advice scenario, I’d remind you that Genovo is massively customisable. If you have alternative wording that you’d prefer to use in your reports, you can use the Report Content Manager to customise the entire boilerplate content of your reports. You’ll find more information on how to do this in the Report Content Manager sub-section of the Customisation section of the Genovo Knowledge Base. In particular, there’s a really useful five-minute video that covers just about anything you need to know about the Report Content Manager.

Additionally, you can use the Advice Option and Reason Library to create your own versions of any of the standard Genovo content. You’ll find more information on how to do this in the Advice Options & Reasons Library sub-section of the Customisation section of the Genovo Knowledge Base. Just as with Report Content Manager above, there’s a really useful video that covers just about anything you need to know about the Advice Option and Reason Library.

Further reading

You’ll find loads more really useful information in:

- Genovo’s series of User Tip blogs;

- the extensive Genovo Knowledge Base;

- the collection of really useful Genovo matrices;

- the ever popular Genovo video tutorials; or

- by attending one or more of our regular monthly training webinars.

Of course, if you’re still stuck, or just need a helping hand, you can always submit a support ticket and we’ll get straight back to you.

Finally – make sure you don’t miss any of our hints & tips – subscribe and get email alerts when we update our blog.