How to write a suitability report advising a client on a pension sharing order

Nigel Ogram

|

IMPORTANT – This user tip relates to an older version of Genovo. Although much of the content and many of the concepts still apply to the current version of Genovo, the screenshots and some instructions may no longer be accurate. |

Last month, I cited Ronseal’s “does what it says on the tin” catchphrase to draw a slightly tenuous link to Genovo’s use of Plain English in the Genovo app and in client reports.

This month’s tenuous link is purely because Genovo’s Cofounder and Head of Operations, Ed Evans challenged me to start the next blog with a link to Marmite… Of course, just like Ronseal, the yucky yeasty spread (your author is a ‘hater’) has its own catchphrase that has entered common language and even Marmite’s own website has adopted the “love it or hate it” tagline.

The challenge of applying this to a User Tip Blog would have been a doddle if the blog subject was something polarising such as should you include other products considered but discounted in your reports, but the subject for this month’s blog had already been decided so the challenge was a bit more, well, challenging. Google was definitely my friend, and it didn’t take long to unearth an article from 2017 in the Suffolk Gazette where a lady’s wanton contamination of the Marmite with a buttery knife was one of the (presumably many) reasons for a divorce.

Which leads me (at last) to this month’s User Tip Blog. Sadly, divorce is commonplace these days and at Genovo we often get asked how to produce a report to detail advice around pension sharing orders. This blog provides a step-by-step guide on how you can quickly and easily write a concise report to a client confirming how to document your advice to add funds from a pension sharing order to a new or existing pension plan.

For the purposes of this blog, I’m going to assume the pension share funds will be going into an uncrystallised plan, but the process would work just the same if the funds were going into a crystallised plan – just change the review and/or recommendation sections mentioned in Step 3 below.

Writing the report

Start your report in the normal way – go to write/ view report and then select (or add) the client. Don’t forget you can write the report on behalf of another user within your account if you have view all users’ clients and reports enabled.

Report creation method

1. The report creation method should be ‘From scratch’. Note that there isn’t a Genovo report template for pension sharing cases, but if you find you’re doing several, you can always create your own template from a client report.

Report type

2. In Report Details, you will be prompted to give the report a name and choose the report type – select Suitability Report and then click Save.

Adding the required sections

3. Once you’ve selected the report type, you’ll be taken to the Report Builder, where you will notice that only the Introduction and Important Information wizard sections are already included – you’ll need to add other required sections yourself from the Available Sections drop-down list.

There’s a really simple choice to make first – is the pension share going into an existing plan belonging to the client, or are you recommending a new plan set up specifically for the purpose of receiving the funds?

a) If the pension share is going to be received by an existing plan, you’ll need the Review of Your Existing Pension Plans section.

b) If the pension share is going to be received by a new plan, you’ll need the New Pension Recommendation section.

Finally, you’ll also need to add the Recommended Investment Strategy section – it’s here that you’ll include details of the clients ATR and capacity for loss, as well as detailing the new investment strategy of a new plan, or a revised investment strategy for an existing plan.

Complete the Wizard Sections

4. You should now work though each of the wizard sections in turn:

a) Introduction section

i) In the Client Circumstances step, you might wish to use the text box to provide the ‘back-story’ to the recommendation, e.g.

ii) In the Objectives step, there is a standard Advice Option that deals with pension sharing orders, and you can click the add KYC info link to edit the objective and provide additional information about the sharing order.

b) Review of Your Existing Pension Plans – where pension share funds are going into an existing plan:

i) You’ll be prompted to provide some information regarding the client’s existing plan(s) within the Plan Summary step. As a bare minimum you should include some basic plan details e.g. provider name, policy number etc and complete the Current Fund Value £ field. Remember you do not have to enter a value for all fields. Empty columns will not show in the Plan Summary table included within your report.

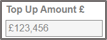

ii) You should add the amount of pension sharing order in the Top-up amount £ field:

iii) You may also wish to include details of the plan’s Current Investment Strategy – this is especially important if the received pension share funds are going into an existing plan and using the same current investment strategy of that plan.

iv) NOTE – you do not need to enter the ex-spouse’s plan from where the pension sharing order funds are being moved. You probably won’t know all of the details of this plan anyway. Instead, you can cover off the details of the ex-spouse’s plan in the Introduction section, as mentioned above.

v) After the Plan Summary step, complete the Benefits and Features and Plan Charges steps as normal.

vi) Next is the Recommended Action step. For the client’s existing plan, you should select ‘invest the pension share within’.

vii) In the Key Disadvantages and Tax Implications step, you should record any disadvantages associated with your recommended action.

c) New Pension Recommendation – where the pension share funds are going into a new plan:

i) Complete the Plan Summary step – add the pension share amount into the Transfer Lump Sum £ field.

ii) Complete the Why Product step as normal with your reasons for selecting the recommended product type.

iii) On the Why Contribution step, you can select from any of the Genovo Advice Reasons. There isn’t one specifically for pension sharing orders, so you can add your own by clicking the add advice reason button and writing your own custom text. Remember that when you create a custom Advice Option or Advice Reason, you can save it to your own Advice Options & Reasons Library, and if you have an Account Admin role in your firm’s Genovo account you can also share it so other users within your Genovo account can use it too:

iv) Finally for this section, complete the Why Provider, Charges, Benefits & Features, Key Disadvantages and Tax Implications, and Other Solutions steps as normal.

d) The next, wizard section is the Recommended Investment Strategy section.

i) In the first two steps, you’ll record the clients Attitude to Risk and Capacity for Loss.

ii) In the Recommended Investment Strategy step, you can:

- detail the revised investment strategy for existing plans where you’re recommending a change to the underlying investment strategy.

- detail the recommended investment strategy for a new plan recommendation.

Remember that there are three ways to create a Recommended Investment Strategy:

- Clone a Current Investment Strategy you’ve previously created in a review section.

- Create a new Recommended Investment Strategy from scratch.

- Clone another Recommended Investment Strategy.

Each of these methods is covered in lots more detail in last month’s User Tip Blog – Everything you wanted to know about investment strategies in Genovo, and more…

5. Your final wizard section is Important Information and should be self-explanatory.

Tailor the report

6. Having completed all the wizard sections, you should then tailor the structure of your report by unchecking any sections you do not wish to include in your report; and then change the sort order of any sections to reflect your personal preferences.

7. And finally, you can download your completed report, with a covering letter if required.

I hope that’s helped you to get to grips and have a better understanding of how to write a report dealing with a pension sharing order.

Nigel’s knowledge

As well as the detailed steps to write a pension sharing order report, this blog also deals with some other interesting subjects that you might wish to explore:

Further reading

You’ll find loads more really useful information in:

- Genovo’s series of User Tip blogs;

- the extensive Genovo Knowledge Base;

- the collection of really useful Genovo matrices;

- the ever popular Genovo video tutorials; or

- by attending one or more of our regular monthly training webinars.

Of course, if you’re still stuck, or just need a helping hand, you can always submit a support ticket and we’ll get straight back to you.

Finally – make sure you don’t miss any of our hints & tips – subscribe and get email alerts when we update our blog.