How to write a Drawdown Review report

Nigel Ogram

|

IMPORTANT – This user tip relates to an older version of Genovo. Although much of the content and many of the concepts still apply to the current version of Genovo, the screenshots and some instructions may no longer be accurate. |

Hi – my first user tip blog of 2022! My last blog dealt with how to write a pension decumulation report – this new blog deals with the inevitable outcome of a decumulation case – the requirement to write regular drawdown review reports!

Reviewing a client’s existing drawdown plan is a regulatory requirement and a normal activity for any adviser with retired clients. Genovo has always provided the ability for users to write drawdown reviews, but our January 2022 release delivered some new and enhanced functionality to improve the process. As more and more clients go into drawdown, the volume of reviews will grow, so I thought it would be a good idea to take a closer look at how Genovo can help.

This article provides a step-by-step guide as to how you can quickly and easily write a brief, concise and compliant report to a client reviewing their existing drawdown plan.

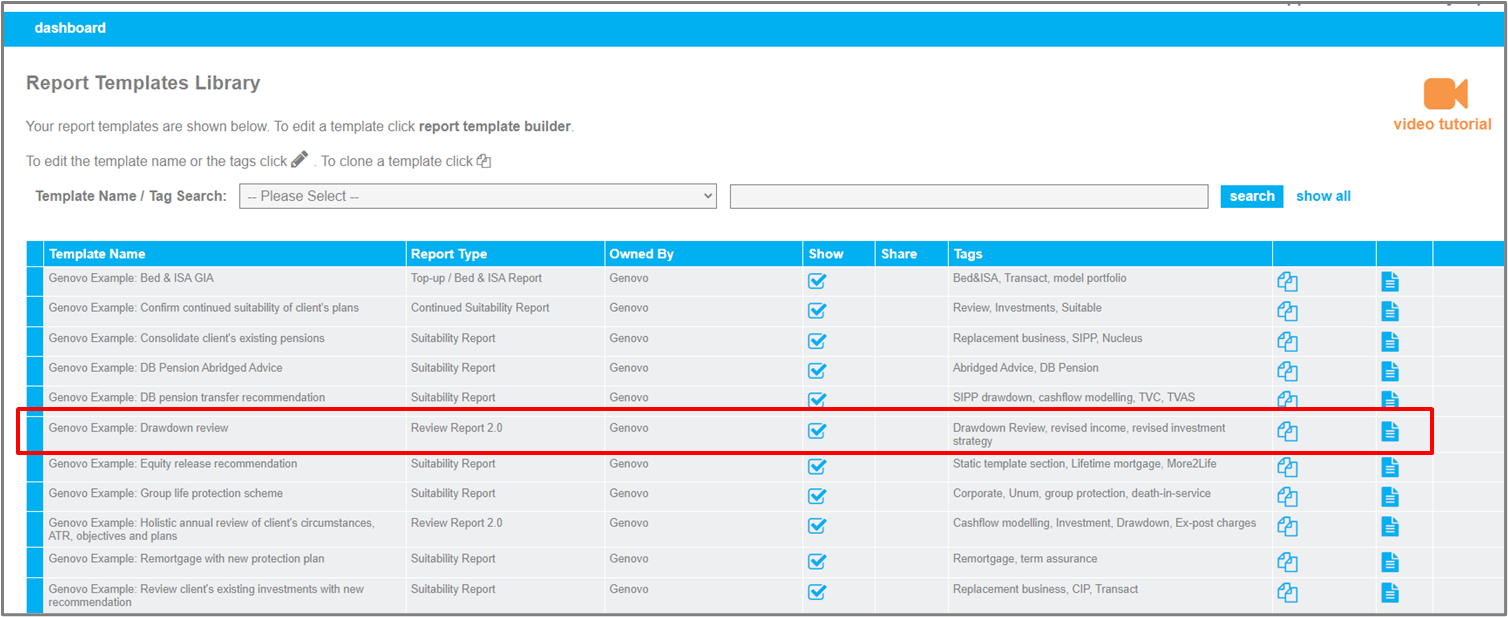

To assist you with the creation of drawdown review reports, we’ve also created a new Genovo Example: Drawdown Review report template (see #2 below).

1) Select or add the client

Go to write / view report and select or add the client(s) for whom you wish to write the report.

Don’t forget if you have an integration set up with your back-office system, you can import the client from the CRM (see the integrations section of the Genovo Knowledge Base for more information). If the client has already been imported into Genovo, you can refresh their details with a click of a button.

2) Select the Report Creation Method

You can either select ‘From scratch’ and build the report from the ground up, or select ‘From an existing template’ and use the Genovo Example: Drawdown Review report template (or a custom drawdown review report template that you or one of your account’s admins has created for you) as the basis for creating your report.

A Report Template is probably the quickest way, but for the purposes of this ‘how-to’ guide, I’ve assumed that you’ll select ‘From scratch’, as it describes the entire sequence.

We’ve created our new Drawdown Review report template to demonstrate the kind of information you’ll need to include in a drawdown review report and also allow you to create a drawdown review report more quickly. In the template, the most appropriate Report Type is pre-selected, all the required report sections have already been selected and some of the section wizard steps have been partially completed. These aspects of a Report Template save time by removing the need for repetition and help to ensure that nothing is missed out of the report.

If the standard Genovo Drawdown Review template isn’t quite what you want, don’t forget you can create your own drawdown template, either by cloning the existing Genovo template and editing it as required, or by converting a drawdown report you create ‘from scratch’ into a report template.

3) Create the report

In Report Details, give the report an appropriate name and select the Report Type (assuming you’re creating the report ‘from scratch’ and not from the Drawdown Review report template – see above).

Because the Genovo Continued Suitability Report has only been designed to fulfil the requirements of MiFID II reporting where there has been no change in the client’s investment objectives and you solely wish to confirm to the client the on-going suitability of their existing investment(s), we would suggest you use the Review Report 2.0. However, it is worth bearing in mind that you can also write a drawdown review using the Suitability Report.

4) Add the required report sections

You’ll then be directed to the Report Builder where you should add the necessary sections from the Available Sections drop down, which in this case will be the Review of Your Existing Retirement Income Plans.

If your drawdown review includes a recommendation to switch the underlying investments of the drawdown plan, you will also need the Recommended Investment Strategy section.

5) Complete all sections wizards

Next, you’ll need to step through the section wizards of all the sections that require your input, starting with the Introduction section, followed by the Review of Your Existing Retirement Income Plans, then (if appropriate) the Recommended Investment Strategy and finally, the Important Information section.

a) Complete the Introduction Section

It’s here that you’ll be prompted to provide an update on the client’s circumstances, a review of their attitude to risk and capacity for loss, plus a review of the client’s objectives. As well as listing the objectives, this step also allows you to add further information to support the objective.

b) Complete the Review of Your Existing Retirement Income Plans section

You’ll be prompted within the Plan Summary step of the review section to enter the drawdown plan information (or import it if you have set up an integration with your company’s back-office system). For a drawdown review, there are some essential fields, such as the fund value, income currently being taken, plus the compliance requirements of comparable annuity, critical yields A and (if applicable) B, and the age that the funds might be exhausted.

Remember you do not have to enter a value for all fields. Empty columns will not be included in the Plan Summary table that’s automatically inserted within your report.

You may also wish to include details of the plan’s Current Investment Strategy.

Next, you’ll be prompted to include details of the plan’s charges in the Plan Charges step. You can enter as much or as little information as you wish about the charges affecting the plan. The charges can be added as a percentage, a monetary amount, some narrative or a combination of all. You will also be prompted to include the Aggregated Total Charge of the plan as a percentage. Having done so, the monetary value of the Aggregated Total Charge will be automatically calculated and inserted into the charges table for you.

In the Recommended Action step, you will need to confirm your recommendation for the plan. There are several to choose from to cover all possible advice scenarios – some examples are:

- retain and maintain the current withdrawals from

- retain and take a revised income from

- start drawing an income from

If your recommendation is for one of the above examples and to switch the investments, you’d use:

- switch the underlying investments of

- switch the underlying investments and take a revised income from

- switch the underlying investments and start drawing an income from

Once you’ve added a Recommended Action, you’ll be able to select existing (or add custom) advice reasons to support it. This step is vitally important, as it’s where you detail the rationale for your recommendation. For drawdown reviews specifically, it is where you’ll confirm the reasons that continuing in drawdown is still appropriate – a very important compliance consideration.

If your Recommended Action involves a change to existing income (up or down) or the withdrawal of a lump sum, you’ll also need to complete the Recommended Withdrawal step. This is where you can specify the amount and frequency of any income and/or withdrawals. Note that there’s also a text box at the bottom of the page where you can add your own text and images if required – this is a great place to insert cashflow planning charts to support a recommendation to revise a client’s drawdown income.

If the Recommended Action doesn’t involve a change to the investment strategy, the last step of this section is Key Disadvantages & Tax Implications. Again, this step is vital, as it allows you to highlight any adverse implications of your recommendation. As always, you should note that in our humble opinion a disadvantage is different to a risk warning, and all relevant risk warnings specific to the advice you’re giving will be automatically inserted into your report.

If your Recommended Action does involve a change to the plan’s Current Investment Strategy, two further steps will also be automatically triggered – Plan Comparison: Investment Strategy Charges and the Plan Comparison: Performance. These steps allow you to record the difference between the charges of the Current Investment Strategy and the Recommended Investment Strategy, as well as any performance differences between the two strategies. Note that if nothing is entered into these steps, nothing will come out in your report.

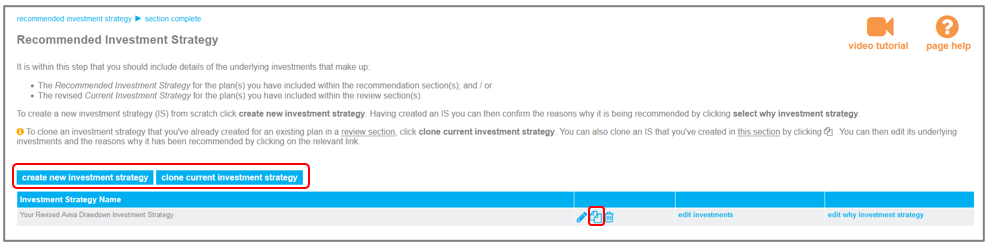

c) Complete the Recommended Investment Strategy section

If appropriate (e.g. you’re recommending a change of investment strategy due to a change in the client’s risk profile) you can use this section to detail the revised investment strategy(s) being recommended. There are three ways to create the new investment strategy:

- Create a new investment strategy from scratch

- Clone a Current Investment Strategy

- Clone a Recommended Investment Strategy

d) Complete the Important Information section

This is the last section you’ll need to complete and is self-explanatory.

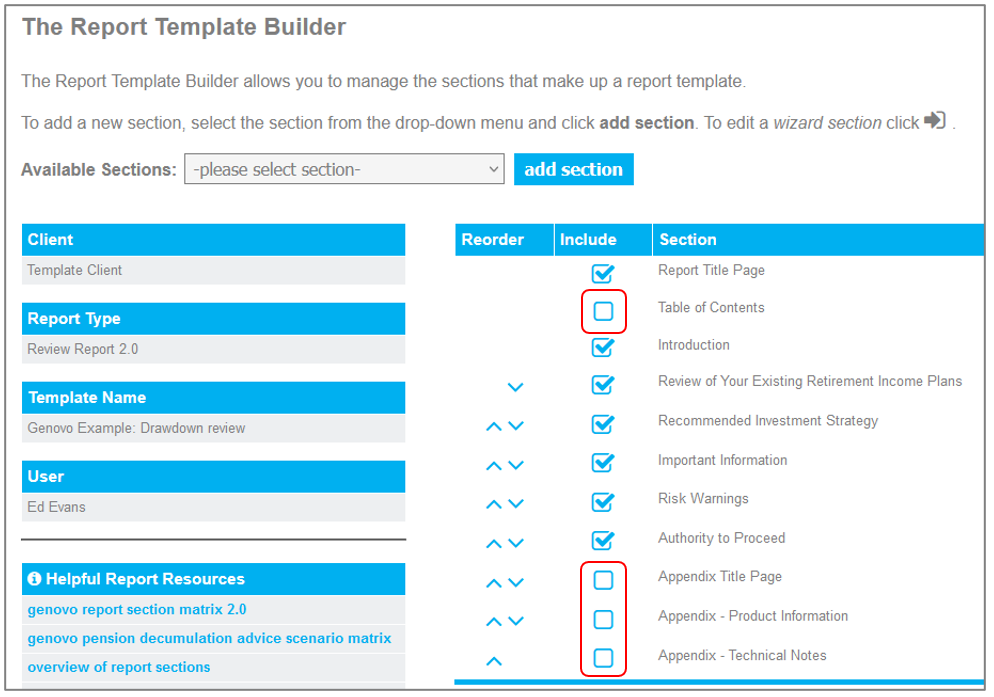

6) Tailor the structure of the report

Having completed all the section wizards you should then tailor the structure of your report by unchecking any sections you do not wish to include in your report; and then change the sort order of any sections to reflect your personal preferences.

For example, on the basis that the client presumably already knows what drawdown is (it’s a review of an existing plan, after all…) you might wish to remove the appendixes (Product Information and Technical Notes). If you remove all the appendixes, don’t forget to remove the Appendix Title Page too.

More information about how to remove optional sections from your report.

More information about how to reorder the report sections

7) Download the report / covering letter

Click the download report / download cover letter icon and the report / covering letter will download to Microsoft Word.

Having created the report, if you prefer it to the Genovo Example: Drawdown review template, you may then wish to convert it into a template and save it to your Report Template Library for future use.

Further Reading

You’ll find loads more really useful information in:

- Genovo’s series of User Tip blogs;

- the extensive Genovo Knowledge Base;

- the collection of really useful Genovo matrices;

- the ever popular Genovo video tutorials; or

- by attending one or more of our regular monthly training webinars.

Of course, if you’re still stuck, or just need a helping hand, you can always submit a support ticket and we’ll get straight back to you.

Finally – make sure you don’t miss any of our hints & tips – subscribe and get email alerts when we update our blog.